November Home Values: Trends in the Australian Property Market

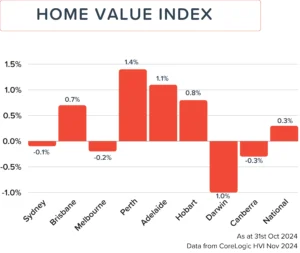

Australia’s capital city median home values going into November have continued to rise, with a national increase of 0.3%. However, that growth is primarily carried by the mid-sized capitals in Australia, with larger cities of Melbourne, Canberra, and Sydney reporting declines in home values. With more and more large-scale cities reporting declines, we could be about to see the pendulum swing.

What is the Home Value Index? [1]

The Home Value Index (HVI), also known as the Hedonic Home Value Index leverages recent property sales across the country to track property trends nationally. It serves as a key metric for analysing the performance of the Australian residential property market.

City Specific Trends

Sydney

Sydney is still comfortably the capital city with the highest median home values, at $1,193,240, however for the first time since January 2023, property prices in Sydney have declined, with a 0.1% drop. This is skewed by steep declines in the more expensive suburbs of Sydney, as lower quartile houses saw a rise in value of 0.5%. It’s likely Sydney’s expensive market may be catching up to itself, and people are less keen to buy.

Brisbane

Brisbane saw a rise of 0.7% in home values this month, with a median home value of $883,357. Eyes will be on Brisbane in the next few month’s HVI reports as it inches closer to the illustrious $1 million mark.

Melbourne

Melbourne continues to report a decrease in property prices, with a 0.2% decline bringing the median home value to $778,926. With the market becoming more accessible to homebuyers, and the Victorian Government’s decision to slash stamp duty on select homes [2], it remains to be seen if we’re about to see a buyers’ boom.

Perth

Perth maintains its strong growth trend with a 1.4% increase. It retains its top spot as Australia’s fastest growing capital city with a value of $804,621. It is getting closer and closer to taking the spot for the third most expensive property market from Canberra.

Adelaide

Adelaide reported a 1.1% increase this month, its lowest growth since June. South A has risen by more than 1% per month for 8 months now. 1.1% while still strong, could be a sign the Adelaide property market could be slowing. The median home value is now $808,644.

Hobart

In a revival fitting for Halloween, Hobart reported a massive jump of 0.8 in median property values, after a decline of 0.4 last month. That’s a month-to-month net recovery of 1.2%. Its median home value now sits at $650,881.

Darwin

After just netting a 0.1% property price increase last month, Darwin reported a 1% decrease in property values. Darwin remains the most affordable capital city in Australia, with a median home value of $492,692.

Canberra

For the second month in a row, Canberra has recorded a 0.3% drop in home values. The average property value is now $850,223. Like Sydney and Melbourne, Canberra’s drop in home values signals a potential shift in the market.

Key Takeaways

Looking at major city trends, it’s likely property prices are looking to a downturn in the near future; however, housing values are still, on the whole, trending upwards. It is worth noting that Sydney, Melbourne, and Canberra are seeing a drop in property prices as a median in the expensive areas of the market, while the more affordable ends of the market are becoming pricier. Likewise, while midsized markets continue to grow, the rate at which they are growing is slowing down.

If you’re looking to purchase your future home, invest in property or refinance your home loan, chat to your local MoneyQuest mortgage broker. We can help you make a suitable decision for your needs, and give you a wide range of solutions.

[1] CoreLogic, 2024, Hedonic Home Value Index November, 1st November 2024. viewed 1st November 2024

[2] Victorian apartment, unit and townhouse buyers to get stamp duty concession when they buy off-the-plan. ABC, 21st October 2024. Viewed 1st November 2024.

Disclaimer:

This article is written to provide a summary and general overview of the subject matter covered for your information only. Every effort has been made to ensure the information in the article is current, accurate and reliable. This article has been prepared without taking into account your objectives, personal circumstances, financial situation or needs. You should consider whether it is appropriate for your circumstances. You should seek your own independent legal, financial and taxation advice before acting or relying on any of the content contained in the articles and review any relevant Product Disclosure Statement (PDS), Terms and Conditions (T&C) or Financial Services Guide (FSG).

Please consult your financial advisor, solicitor or accountant before acting on information contained in this publication.

Proudly Part Of

The Money Quest Group (MQG) is one of Australia's leading boutique mortgage broking businesses, with a network of more than 600 brokers nationwide. Known for their exuberant culture and superior support, MQG provides brokers access to a range of financial products from more than 60 lending institutions and suppliers, and exclusive access to in-house benefits and services.

© 2017-2025 MoneyQuest Australia Pty Ltd, Australian Credit Licence 487823