Home Values Continue Their Streak Into September

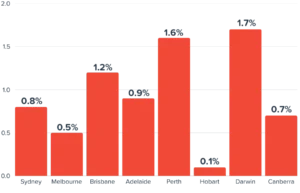

National home values have seen their largest median increase in two years, as every capital city recorded an increase month-to-month. While Brisbane has maintained it’s strong growth, It was actually Perth that’s seen a larger month-to-month increase when it comes to percentage, with a growth of 1.6%. The smaller market of Darwin has seen a massive 1.7% increase in September, while Hobart just cinched forward with a 0.1% increase. This is great news across the board for homeowners and investors looking at capital growth, but it’s creating a larger an larger hurdle for first-homebuyers trying to get their foot in the door.

What is the Home Value Index (HVI)?

The Home Value Index (HVI), also known as the Hedonic Home Value Index, leverages recent property sales to track property trends across the country. It serves as a key metric for analysing the performance of the Australian residential property market.

Source: Cotality HVI Report October 2025

Perth Beats Brisbane to the Punch

Brisbane and Perth continue to be neck-in-neck for the property growth rate, pulling ahead of larger capital cities. Perth has spent recent years as the smart home buyer and investor’s choice, as it’s dwellings are at a lower price with rapid growth. However, with dwellings at historic lows [2], the question raises how long it will remain accessible to those looking to buy. With the median property worth over $855,000, Perth’s property market has well overtaken Melbourne in the market, and will likely continue to rise.

What Does This Mean For First-Home Buyers

The situation for first-home buyers is a mixed bag. October sees property price caps for each state increase, meaning first home buyers may have access to more properties. It’s worth seeing how those property caps reflect median home values in Capital cities.

Sydney

First-home buyers in Sydney can access properties up to $1,500,000 with as little as 5% deposit. This is above the median property value of $1,241,054.

Melbourne

First-home buyers in Melbourne can access properties up to $950,000 with as little as 5% deposit. This is well above the median property value of $805,880

Brisbane

First-home buyers in Brisbane can access properties up to $1,000,000 with as little as 5% deposit. This is above the median property value of $969,868, but not by much.

Adelaide

First-home buyers in Adelaide can access properties up to $900,000 with as little as 5% deposit. This is just above the median property value of $855,998.

Perth

First-home buyers in Perth can access properties up to $850,000 with as little as 5% deposit. This is actually just below the median property value of $855,267, meaning first-home buyers can access approximately less than half the property market.

Hobart

First-home buyers in Hobart can access properties up to $700,000 with as little as 5% deposit. This is above the median property value of $683,390, but not by much.

Darwin

First-home buyers in Darwin can access properties up to $600,000 with as little as 5% deposit. This is above the median property value of $558,595.

Canberra

First-home buyers in Canberra can access properties up to $1,000,000 with as little as 5% deposit. This is above the median property value of $885,942.

While larger capital cities, like Melbourne, Sydney and Canberra, have provided a significant buffer with the increase in property price caps, other markets seem to be just on the razors edge of the median property value. Given the continuous increase in property prices, as well as the high demand and low supply of this buying season, it remains to be seen if the majority of capital cities continue to have markets accessible to first home buyers.

If you’re looking to buy your first home, your journey starts with meeting with a mortgage broker. We can help explore government grants and concessions available to you, assess borrowing power and help find a loan that suits your needs from across over 60 lenders. Get started today.

[1] Cotality. HVI Oct 2025. 1st of October 2025. Viewed 6th of October 2025.

[2] Slade, L. House prices to rise as wave of first home buyers expected. AFR. 1st of October 2025. Viewed 6th of October 2025.

Disclaimer:

This article is written to provide a summary and general overview of the subject matter covered for your information only. Every effort has been made to ensure the information in the article is current, accurate and reliable. This article has been prepared without taking into account your objectives, personal circumstances, financial situation or needs. You should consider whether it is appropriate for your circumstances. You should seek your own independent legal, financial and taxation advice before acting or relying on any of the content contained in the articles and review any relevant Product Disclosure Statement (PDS), Terms and Conditions (T&C) or Financial Services Guide (FSG).

Please consult your financial advisor, solicitor or accountant before acting on information contained in this publication.

Proudly Part Of

The Money Quest Group (MQG) is one of Australia's leading boutique mortgage broking businesses, with a network of more than 600 brokers nationwide. Known for their exuberant culture and superior support, MQG provides brokers access to a range of financial products from more than 60 lending institutions and suppliers, and exclusive access to in-house benefits and services.

© 2017-2025 MoneyQuest Australia Pty Ltd, Australian Credit Licence 487823