August Home Values Show Strong Growth Rate

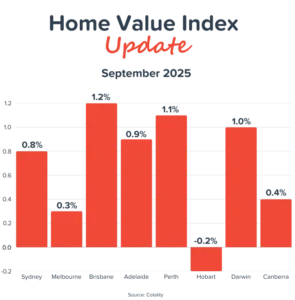

Spring has only just begun, but the property market is already heating up – with home values rising at their fastest pace in over a year, at 0.7%. In August all capital cities, except Hobart, experienced month-to-month growth of at least 0.3%. This comes off the back of an August cash rate cut and a push forward for the First Homebuyer’s Deposit Scheme. Auction clearance rates are at a high not seen since February 2024.

What is the Home Value Index (HVI)?

The Home Value Index (HVI), also known as the Hedonic Home Value Index, leverages recent property sales to track property trends across the country. It serves as a key metric for analysing the performance of the Australian residential property market.

Brisbane Continues to Lead the Pack

Brisbane continues to be the market leader when it comes to month-to-month growth. While Sydney is still the most expensive property market nationally, Brisbane has risen to be the second most expensive capital city when it comes to median home values, cleanly overtaking Melbourne with a median home value of $934,623. Another mid-sized capital city, Perth, saw the second largest month-to-month growth, with a median 1.1% rise in home values with a median home value of $831,923.

What This Means for Vendors

Those looking to sell their home in the coming months may be in prime position, as many market factors are working to support vendors.

Recent cash rate cuts alongside planned changes to the cash rate have helped boost buyer activity, and with property price caps increasing for first homebuyers as of the 1st of October, first homebuyers may also be able to compete for higher value properties. For example, the cap in Brisbane has been increased to $1,000,000, which means, in theory, they could afford a median-priced property in Brisbane with a 5% deposit, without having to pay LMI.

This is good news for buyers – and great news for vendors. More first homebuyers in the market means more competition, the potential for higher auction clearance rates and higher selling prices. While The Australian Treasury projects the change in first homebuyer deposit scheme will only boost property prices 0.5%, The Insurance Council of Australia is accounting for up to a 10% increase in property prices in some areas, which could make it that much harder for buyers who are struggling to enter the property market [2]. Looking forward to the end of the year, it’s likely we’ll continue to see property prices rise across the next few months nationally.

Other Insights

Factors across the board seem to be moving in favour of homeowners. Consumer sentiment has improved, and homeowners are now moving slowly towards being able to accrue savings. Wage growth is also keeping pace, and unemployment is low. These factors build what is hopefully a strong property market for homebuyers and homeowners alike heading into Spring and Summer [1]. If you’re thinking about buying, selling, or simply reviewing your home loan, our team is here to help you make your next move with confidence.

[1] Cotality. HVI August 2025. 2nd of September 2025. Viewed 3rd of September 2025

[2] Garman, L. ‘Think twice’: Expert slams new first homebuyer scheme. 2nd of September 2025. Viewed 3rd of September 2025

Disclaimer:

This article is written to provide a summary and general overview of the subject matter covered for your information only. Every effort has been made to ensure the information in the article is current, accurate and reliable. This article has been prepared without taking into account your objectives, personal circumstances, financial situation or needs. You should consider whether it is appropriate for your circumstances. You should seek your own independent legal, financial and taxation advice before acting or relying on any of the content contained in the articles and review any relevant Product Disclosure Statement (PDS), Terms and Conditions (T&C) or Financial Services Guide (FSG).

Please consult your financial advisor, solicitor or accountant before acting on information contained in this publication.

Proudly Part Of

The Money Quest Group (MQG) is one of Australia's leading boutique mortgage broking businesses, with a network of more than 600 brokers nationwide. Known for their exuberant culture and superior support, MQG provides brokers access to a range of financial products from more than 60 lending institutions and suppliers, and exclusive access to in-house benefits and services.

© 2017-2025 MoneyQuest Australia Pty Ltd, Australian Credit Licence 487823