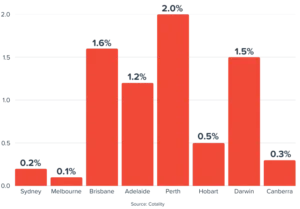

February Home Values: Growth in Every Capital City

Home Values in January saw growth across every capital city, even Melbourne and Sydney that reported losses last month are back on the upward swing, just. This comes amongst questions regarding affordability and serviceability in a tight property market nationwide.

What is the Home Value Index (HVI)?

The Home Value Index (HVI)[1], also known as the Hedonic Home Value Index, leverages recent property sales from each state to track the median value growth of homes nationwide. It serves as a key metric for analysing the performance of the Australian residential property market and is useful when looking at the affordability and investment potential of states and capital cities.

Source: Cotality HVI Report February 2026

State Market Report

These median values are as at 2nd of February 2026.

Sydney

The median home value has increased 0.2% , and is now $1,290,537.

Melbourne

The median home value has increased 0.1% , and is now $830,371.

Brisbane

The median home value has increased 1.6% and is now $1,054,555.

Adelaide

The median home value has increased 1.2% , and is now $914,203.

Perth

The median home value has increased 2.0% , and is now $961,898.

Hobart

The median home value has increased 0.5% , and is now $722,339.

Darwin

The median home value has increased 1.5% and is now $602,870.

Canberra

The median home value has increased 0.3% and is now $884,844.

Mid Size Capitals Drive Growth

Perth Adelaide and Brisbane continued to see sustained growth, only outpaced by the smaller city of Darwin. However, there is a notable drop when compared to December. Brisbane’s growth dropped from 2.0% to 1.6%, while Perth and Adelaide also slowed down.

Coming months could see affordability pressures ease slightly. Cotality’s Tim Lawless says “Affordability and serviceability constraints are likely to naturally dampen demand, but also renewed cost of living pressures and a strong chance that interest rates will rise. There is also slowing population growth to consider.”[1]

Property Market is Staying Strong, But For How Long?

Inventory remains low, with homes advertised for sale still 19% down year-on-year, while demand remains high, driving prices up.

However with a rate hike on Tuesday, alongside permeating affordability and serviceability constraints, we may see home values cool in the coming months.

Want more information on what this means for your finance goals? Reach out to your local MoneyQuest broker for a zero-cost, zero-obligation chat to plan your next steps, so you can borrow, invest and refinance with confidence.

[1]Cotality (2026) February Home Value Index: Cotality. Available at: https://discover.cotality.com/hubfs/ArticleReports/COTALITY%20HVI%20Feb%202026%20FINAL%201.pdf [Accessed 4th February 2026].

Disclaimer:

This article is written to provide a summary and general overview of the subject matter covered for your information only. Every effort has been made to ensure the information in the article is current, accurate and reliable. This article has been prepared without taking into account your objectives, personal circumstances, financial situation or needs. You should consider whether it is appropriate for your circumstances. You should seek your own independent legal, financial and taxation advice before acting or relying on any of the content contained in the articles and review any relevant Product Disclosure Statement (PDS), Terms and Conditions (T&C) or Financial Services Guide (FSG).

Please consult your financial advisor, solicitor or accountant before acting on information contained in this publication.

Proudly Part Of

The Money Quest Group (MQG) is one of Australia's leading boutique mortgage broking businesses, with a network of more than 600 brokers nationwide. Known for their exuberant culture and superior support, MQG provides brokers access to a range of financial products from more than 60 lending institutions and suppliers, and exclusive access to in-house benefits and services.

© 2017-2025 MoneyQuest Australia Pty Ltd, Australian Credit Licence 487823