How Having Children Can Impact Your Borrowing Capacity

Don’t get the wrong idea, having kids is a gift and for most, the happiest most fulfilling time of their lives. Lenders understand this and are not against those who have children.

It goes without saying that having children increases your living expenses, and lenders take this into consideration when evaluating your capacity to make repayments on a home loan. Similar to how Lenders Mortgage Insurance exists to protect the lender against any loss, lenders also protect themselves by taking dependents into account when assessing a loan applicant’s financial situation.

How Is Your Borrowing Power Calculated?

Before we break down exactly how having kids can affect your borrowing capacity, it’s important to understand how borrowing power is calculated.

Each lender has a system to determine the borrowing capacity of loan applicants, however each system is based on the Melbourne Institute’s HEM concept (Household Expenditure Measure), which is considered the industry benchmark in Australia.

These are some of the factors that HEM considers:

- Location

- Household type – Single, Couple, Family etc.

- Number of dependents

- Median lifestyle expenses (student, basic, moderate or lavish)

- The ‘basic’ lifestyle expense tier sits at around $32,400 per year according to UBS and is used in the majority of applications.

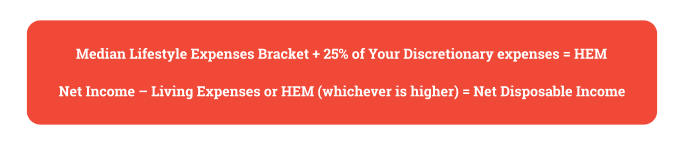

The HEM is calculated by adding the median lifestyle expenses from your bracket, to 25% of your discretionary expenses.

Once you have provided your lender with your weekly or monthly expenses, they will compare these with your Household Expenditure Measure figure and will choose the highest amount.

From here, they’ll take your net income (income after tax), and subtract your expenses (or the HEM figure, whichever is higher) to determine your net disposable income (NDI). If your NDI is equal to or higher than your expenses, (depending on the lender) your maximum borrowing capacity will be calculated and your loan will most likely be approved.

We’ve done the hard work for you and have broken this down into an easy formula:

Quick Tip: If you’re looking for a convenient way to calculate your living expenses against your income, why not use our handy Budget Planner calculator! Once you’ve determined your living expenses, head over to our Borrowing Power Calculator to get an estimate of your borrowing power.

Phew! Now that we know how borrowing power is calculated, let’s explore how children (also known as dependents) can affect this.

How Does Having a Child Affect Your Mortgage?

Before we delve into how and to what extent children can impact your borrowing power, let’s cover off how much it costs to raise the average child in Australia.

According to the Australian Institute of Family Studies, “the estimated weekly costs for low-paid families raising two children – a 6 year-old girl and a 10 year-old boy – is $340 per week, or $170 a week per child.”

This comes to $17,680 for two children, or $8,840 for one child, per year.

So when calculating the average family of four’s borrowing capacity, this amount would be deducted from their net disposable income, which would in turn, reduce how much they’re eligible to borrow.

So to what extent does having a child affect borrowing power?

So to what extent does having a child affect borrowing power?

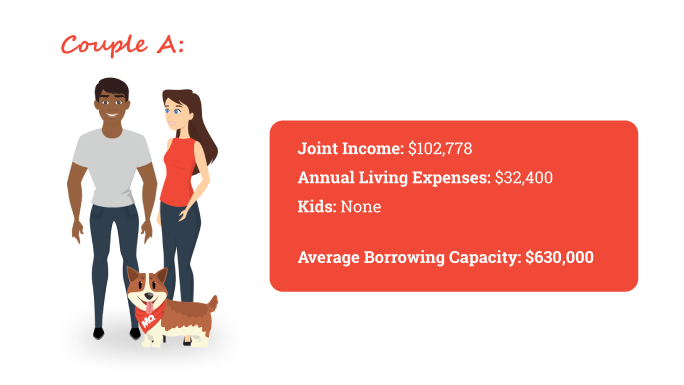

Meet, couple A. They make $51,389 each, per year (the Australian median annual salary). Couple A have no kids with annual living expenses that total $32,400 (based off the ‘basic’ expenses bracket from HEM). If we were to calculate their borrowing capacity with each of the big four banks in Australia, and average it out, they could borrow around $630,000.

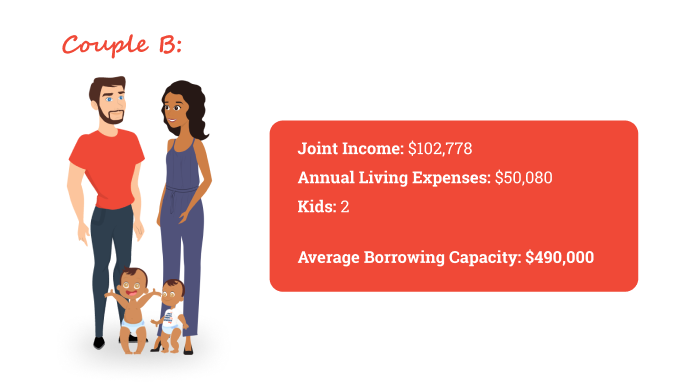

Now let’s take a look at couple B. They earn the same amount per year as couple A, except they have 2 children and their annual living expenses amount to $50,080 (AIF’s cost of raising 2 kids + the ‘basic’ expenses bracket from HEM). If we made the same borrowing power calculations with these new figures, couple B would only be able to borrow around $490,000.

This demonstrates that the cost of having two children reduces couple B’s borrowing capacity by around $140,000. Keep in mind, these figures are based on national averages and may not reflect your financial circumstances.

So, How Can I Increase My Borrowing Power If I Have Children?

It’s all about trying to increase your net disposable income (NDI). The more NDI you have, the higher your borrowing capacity is likely to be. So, here are 5 ways to increase your borrowing power.

1. Save a larger deposit.

Saving for a larger deposit can help you to reach your goals sooner, but it’s understandable that this approach is not the easiest or quickest solution.

2. Shave off any debts.

Credit cards can lower your borrowing capacity. A $5,000 credit card limit, for example, can reduce your borrowing power more than you think, even if your balance is zero!

3. Negotiate a pay rise or start a side hustle.

Increasing the amount you take home through a pay rise can be the quickest way to increase your borrowing power. Alternatively, if you have skills in other areas that can potentially earn you money, start a side hustle outside of business hours!

4. Lower your expenses.

Review your living expenses and identify areas where you might be able to cut back. Do you have a gym membership you barely use? Are you subscribed to a streaming service you never watch? Could you cut back on your Uber Eats orders? Making small changes can enhance your savings.

How A Mortgage Broker Can Put Your Best Case Forward

The role of a mortgage broker is to guide you through the lending process step by step, and to assist you with finding a home loan that suits your needs, goals and financial situation. Mortgage brokers crunch the numbers for you and assess your borrowing capacity, taking into account market trends, fluctuations and your lifestyle. They will then present you with a range of home loan options to consider.

Once you decide on a home loan, mortgage brokers then sort out all the necessary paperwork and put your best case forward to the bank. They are also legally obligated to act and provide advice that is in your best interests, so you can rest assured that any credit advice you are given has been provided with your best interests in mind. The best part is, our MoneyQuest mortgage brokers offer their services completely free of charge!

So whichever stage of the homebuying journey you’re at, get in touch with your local MoneyQuest mortgage broker today!

Disclaimer:

This article is written to provide a summary and general overview of the subject matter covered for your information only. Every effort has been made to ensure the information in the article is current, accurate and reliable. This article has been prepared without taking into account your objectives, personal circumstances, financial situation or needs. You should consider whether it is appropriate for your circumstances. You should seek your own independent legal, financial and taxation advice before acting or relying on any of the content contained in the articles and review any relevant Product Disclosure Statement (PDS), Terms and Conditions (T&C) or Financial Services Guide (FSG).

Please consult your financial advisor, solicitor or accountant before acting on information contained in this publication.

Proudly Part Of

The Money Quest Group (MQG) is one of Australia's leading boutique mortgage broking businesses, with a network of more than 600 brokers nationwide. Known for their exuberant culture and superior support, MQG provides brokers access to a range of financial products from more than 60 lending institutions and suppliers, and exclusive access to in-house benefits and services.

© 2017-2025 MoneyQuest Australia Pty Ltd, Australian Credit Licence 487823