What Will Happen to Interest Rates? – December Rate Report

There are just over 2 weeks left in 2024, and the Reserve Bank of Australia (RBA) has made their final call of the year. It’s been over 4 years since the last cash rate cut, and since then, the cash rate has skyrocketed to heights unseen since 2011 [1] (Stevens, 2011). So, has December gifted us a Christmas cash rate cut?

The cash rate started 2024 at 4.35%, and to the disappointment of many, that’s how it will end the year. However, it only feels like a matter of time before the RBA makes the call and brings the cash rate down.

Internationally, rates are dropping. The Reserve Bank of New Zealand lowered its cash rate from 4.75% to 4.25% at the end of November, as inflation, like Australia, drops into the RBNZ’s preferred bandwidth.[2] (2024) However, while New Zealand’s inflation is similar to our own, New Zealand is also struggling with high unemployment. As stated by the RBA:

“More jobs and higher wages increase household incomes and lead to a rise in consumer spending, further increasing aggregate demand and the scope for firms to increase the prices of their goods and services.” [3]

The relationship between unemployment and inflation

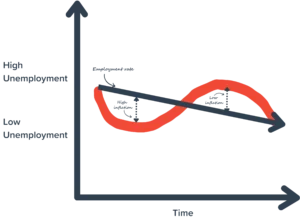

A big part of reducing unemployment without leading to hazardous inflation is the Non-Accelerated Inflation Rate of Unemployment (NAIRU). The NAIRU is the lowest possible unemployment rate a country can achieve without rising inflation. Higher unemployment creates less spending and less consumer inflation, while low unemployment promotes spending. The goal is to keep unemployment low without promoting an environment for excessive consumer spending.

Because of this tug-of-war relationship, the state of the cash rate and interest rates has the opposite effect on employment as it does on inflation. Lower interest rates can lower unemployment, while higher interest rates combat inflation.

Australia has steadier unemployment than New Zealand, and as such, doesn’t feel the urge to lower interest rates to reduce the unemployment rate [4]. However, while higher interest rates may help ease inflation, and unemployment isn’t a major threat to most Aussies at the moment, we know that homeowners are suffering, and a refusal to ease the cash rate can be damaging to those who have a mortgage.

What Does This Cash Rate Decision Mean For Homeowners?

Homeowners have seen their repayments spike over the last 3 years, and understandably, may not feel as though they are getting what they signed up for when they first purchased their home. If you’re struggling to meet repayments, you’re not alone, as 42% of Australian homeowners with a home loan have reported financial stress [5] (Martin, 2024).

If you are struggling, get in touch. While we can’t make mortgage troubles go away entirely, we may be able to help ease the pain by exploring refinancing options.

What Does This Cash Rate Decision Mean for Homebuyers?

High interest rates mean that if you purchase a home now, you’ll be paying more on mortgage repayments. However, home prices in key capital cities such as Melbourne and Sydney are on the decline. It’s likely only a matter of time until interest rates are cut, So purchasing now could be a good strategy to get ahead of any competition.

When Will Interest Rates Drop?

While we can’t say when the RBA will cut the cash rate, it’s looking more and more likely that it will be within the financial year. A majority of the major banks project a cash rate cut in May.

Whether you’re looking for home loan relief, want to get ahead of the home-buying rush, or want to build your investment strategy, the MoneyQuest team is here to help. We can help find a finance solution to support you heading into the new year.

[1] Stevens, Glenn. Statement by Glenn Stevens, Governor: Monetary Decision. Reserve Bank of Australia, November 2011. Viewed December 10th 2024.

[2] RBNZ, OCR 4.25% – OCR lowered further as inflation returns to target. 27th November 2024. Viewed December 10th 2024.

[3]RBA, The Non-Accelerating Inflation Rate of Unemployment (NAIRU). Viewed December 10th 2024.

Disclaimer:

This article is written to provide a summary and general overview of the subject matter covered for your information only. Every effort has been made to ensure the information in the article is current, accurate and reliable. This article has been prepared without taking into account your objectives, personal circumstances, financial situation or needs. You should consider whether it is appropriate for your circumstances. You should seek your own independent legal, financial and taxation advice before acting or relying on any of the content contained in the articles and review any relevant Product Disclosure Statement (PDS), Terms and Conditions (T&C) or Financial Services Guide (FSG).

Please consult your financial advisor, solicitor or accountant before acting on information contained in this publication.

Proudly Part Of

The Money Quest Group (MQG) is one of Australia's leading boutique mortgage broking businesses, with a network of more than 600 brokers nationwide. Known for their exuberant culture and superior support, MQG provides brokers access to a range of financial products from more than 60 lending institutions and suppliers, and exclusive access to in-house benefits and services.

© 2017-2025 MoneyQuest Australia Pty Ltd, Australian Credit Licence 487823