Home Values Continue to Climb in May

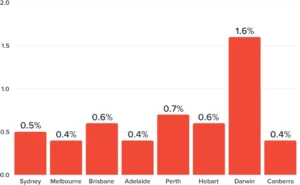

Following the Federal Election, which saw a dominant performance from Australia’s Labor Party, and a cash rate cut just a couple week’s ago, home values have continued to climb in every state for the third month in a row. Cotality (formerly Corelogic) reports that home values increased 0.5% nationally, with Darwin exhibiting the most growth with 1.6%, while mid sized to larger cities like Melbourne, Adelaide and Canberra saw the smallest increment with 0.4% growth.

What is the Home Value Index (HVI)?

The Home Value Index (HVI), also known as the Hedonic Home Value Index, leverages recent property sales across the country to track property trends across the country. It serves as a key metric for analysing the performance of the Australian residential property market.

Why Do Home Values Continue to Climb?

The answer’s simple; Australia has seen two unprecedented rate cuts this year. Buyers are able to borrow more, meaning more buyer activity. “The continued momentum we’re seeing is no doubt being fuelled by rate cuts – both those that have already happened, but also the potential cuts in the coming months.”[1] said, Tim Lawless, Cotality Research Director (2025).

More cash rate activity is expected later this year, so it may be a while yet before we see property prices in any capital city dip.

A Slowing Market

While property markets nationally are all on the rise, the rate at which they’re climbing has slowed noticeably, particularly in the mid sized capitals that, led the market in 2024.

Mid sized capitals like Perth and Adelaide are growing at a pace consistent to larger markets like Sydney and Melbourne.

Darwin as an Outlier

The only capital to see more than a percentage growth was Darwin. Darwin’s 1.6% growth more than doubled the second highest capital of Perth in percentage. Keep in mind however that in terms of actual values, Darwin’s median property value is now $525,770, while a dwelling in Perth is at a median value of $813,810.

Future Growth on the Horizon

As stated by Cotality’s Tim Lawless, Home Values are expected to climb. This is great news for those with a home or investment property, as your equity should continue to grow. Homebuyers can expect more competition, and higher prices.

Whether you’re looking to buy, invest or refinance, your local MoneyQuest Mortgage broker can help. From accessing home equity, to unlocking borrowing power to refinancing to a more competitive rate, we’re here to help. Get in touch with us today!

[1] Cotality, Home Value Index. embargoed Monday 2nd June 2025

Disclaimer:

This article is written to provide a summary and general overview of the subject matter covered for your information only. Every effort has been made to ensure the information in the article is current, accurate and reliable. This article has been prepared without taking into account your objectives, personal circumstances, financial situation or needs. You should consider whether it is appropriate for your circumstances. You should seek your own independent legal, financial and taxation advice before acting or relying on any of the content contained in the articles and review any relevant Product Disclosure Statement (PDS), Terms and Conditions (T&C) or Financial Services Guide (FSG).

Please consult your financial advisor, solicitor or accountant before acting on information contained in this publication.

Proudly Part Of

The Money Quest Group (MQG) is one of Australia's leading boutique mortgage broking businesses, with a network of more than 600 brokers nationwide. Known for their exuberant culture and superior support, MQG provides brokers access to a range of financial products from more than 60 lending institutions and suppliers, and exclusive access to in-house benefits and services.

© 2017-2025 MoneyQuest Australia Pty Ltd, Australian Credit Licence 487823