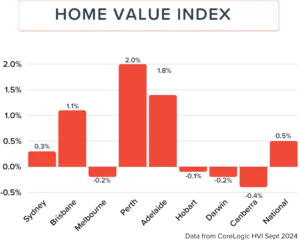

September Home Values: Trends in the Australian Property Market

For the 19th month in a row, CoreLogic has reported a national increase in home values. The Home Value Index (HVI) also rose 0.5% for the 3rd month in a row.

What is the Home Value Index? [1]

The Home Value Index (HVI), also known as the Hedonic Home Value Index uses recent property sales across the country to report the trends of property growth nationwide. It’s a crucial metric for analysing the Australian residential property market.

City Specific Trends

Sydney

For another month, Sydney saw mild growth at 0.3% , for a median property value of $1,180,463.

Brisbane

Just as we saw with Sydney, Brisbane saw identical growth to last month at 1.1%, with a median value of $875,040.

Melbourne

Melbourne’s downward trend in terms of property value saw a slight alleviation, with a decline of only 0.2%. despite this, Melbourne has slid below Perth and Adelaide to become the third lowest median property value at $776,044. CoreLogic’s Tim Lawless predicts it’s the volume of units in Melbourne [2] which is drawing it’s median value down.

Perth

When it comes to month-to-month growth, Perth still leads the pack with a 2% increase. The median property value is now $785,250.

Adelaide

Adelaide has overtaken Melbourne as the Capital City with the third highest median property value. A 1.4% increase in value brings it to $790,789.

Hobart

After a strong downturn of -0.5% last month, Hobart stabilised slightly with a decrease of just -0.1% this month. It still carries the second lowest dwelling of any capital city with a median property value of $655,114.

Darwin

Darwin is still the cheapest capital city, with it’s reduction of -0.2% taking it’s median property value to $504, 367

Canberra

After seeing no notable change last month, Canberra’s dwelling value dropped -0.4% in the month of August. The median property value is now $845,875.

[1] CoreLogic, 2024, Hedonic Home Value Index September

[2] Malo, Jim. 2024, The type of home that’s holding the Melbourne property market back The Age / Domain

Disclaimer:

This article is written to provide a summary and general overview of the subject matter covered for your information only. Every effort has been made to ensure the information in the article is current, accurate and reliable. This article has been prepared without taking into account your objectives, personal circumstances, financial situation or needs. You should consider whether it is appropriate for your circumstances. You should seek your own independent legal, financial and taxation advice before acting or relying on any of the content contained in the articles and review any relevant Product Disclosure Statement (PDS), Terms and Conditions (T&C) or Financial Services Guide (FSG).

Please consult your financial advisor, solicitor or accountant before acting on information contained in this publication.

Proudly Part Of

The Money Quest Group (MQG) is one of Australia's leading boutique mortgage broking businesses, with a network of more than 600 brokers nationwide. Known for their exuberant culture and superior support, MQG provides brokers access to a range of financial products from more than 60 lending institutions and suppliers, and exclusive access to in-house benefits and services.

© 2017-2025 MoneyQuest Australia Pty Ltd, Australian Credit Licence 487823