Is Spring the Best Time to Sell Your Home in Australia?

In the property world, selling your home in spring is as synonymous with the season as new leaves, baby birds, and clean houses. Spring ‘s reputation as the most suitable time to sell your home, owes to naturally vibrant gardens, good weather, and perceived lower mortgage rates as a rule of thumb. However, is there any credence to selling in the spring?

Why is spring a popular selling season?

Spring’s closely associated with renewal and rebirth, so it makes sense that, at least thematically, it lines up with moving on from a property.

Great weather conditions also add to spring’s reputation as an ideal time to sell. Plant life is typically at its most luscious, and the weather is nice, which means buyers are more likely to attend inspections and auctions.

It’s also believed that in Spring, property prices are higher, and buyers are more active and motivated to purchase.

Is selling your home in spring actually better?

The claims that this season “springs” the property market back to life isn’t unfounded. Spring regularly sees more activity, and 2023 saw a healthy property market, with home values growing and plenty of competition from buyers, despite high interest rates.

However, the results are in line with the trends seen throughout the entire year. Despite predictions that 2023 would see property prices soften, the year saw unprecedented population growth, low unemployment rates and low vacancy rates, feeding a hot market year-round.

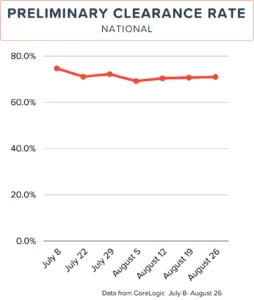

Winter 2024 did see a slow in auctions and preliminary clearance volume, showing a less convenient market for sellers, while the market is slowly rebuilding for a prosperous springtime. Despite this, early winter did see the highest preliminary clearance rate since April, at 74.7%.

While there’s arguments to be made for both middle of and end of the year, it’s undeniable that spring still stands tall, if simply because most people already associate it with selling. If you’re looking to sell a property, whether its an investment or your home, Spring could provide the benefits you need for a better sale.

Top 3 tips for selling your home in spring.

1. Find the right real estate agent for you.

A real estate agent can be a costly investment, but to speed up the process it can be worth working with the professionals. They know the area, promote your property for sale and connect you with interested buyers.

Be sure to scout the real estate agents that are best for you. What’s their sales record like? Do they communicate well and listen to your needs? Are they within your budget? Finding a real estate agent is a big decision, so find one compatible with you and your situation.

2. Clean and Stage

This is the most important step. When people step into your home, they need to be able to envision themselves living there, so keep it clean, stylish and neat, but consider taking down anything too personal. Read more on staging here.

Also, make sure to spend a couple of hours making the house as clean as possible, maybe splash out for a professional cleaner, or rest on your skills and go to town on the house! See some of our cleaning tips below!

• Spring Cleaning for Property Season

• 6 Cleaning Hacks for a Sparkly, Tidy Home

3. Make any repairs and maintenance

A home buyer wants a property in good condition, and making quick, sensible repairs can increase the value of your property, so make sure to perform any repairs and maintenance so that your home is appealing to buy.

A fresh coat of paint on the walls, a fix-up of the property’s façade and new flooring can build the value of the home and increase your asking price.

It may also be worth doing a light renovation on the kitchen and bathrooms. Small things like stovetops, kitchen benches, and faucets can make a big difference, just don’t forget tip no. 2, and make sure you don’t inject too much of your own personality into the style.

Additionally, it’s good form to check the plumbing, electricity, and other utilities for maintenance and upgrades.

If you’re looking for your next home or investment property, be sure to reach out to us today! We can help you secure a loan that suits your needs and take the next step in your finance journey!

Disclaimer:

This article is written to provide a summary and general overview of the subject matter covered for your information only. Every effort has been made to ensure the information in the article is current, accurate and reliable. This article has been prepared without taking into account your objectives, personal circumstances, financial situation or needs. You should consider whether it is appropriate for your circumstances. You should seek your own independent legal, financial and taxation advice before acting or relying on any of the content contained in the articles and review any relevant Product Disclosure Statement (PDS), Terms and Conditions (T&C) or Financial Services Guide (FSG).

Please consult your financial advisor, solicitor or accountant before acting on information contained in this publication.

Proudly Part Of

The Money Quest Group (MQG) is one of Australia's leading boutique mortgage broking businesses, with a network of more than 600 brokers nationwide. Known for their exuberant culture and superior support, MQG provides brokers access to a range of financial products from more than 60 lending institutions and suppliers, and exclusive access to in-house benefits and services.

© 2017-2025 MoneyQuest Australia Pty Ltd, Australian Credit Licence 487823